JUS GENTIUM, THIS IS A REPUBLIC FORM OF GOVERMENT WITH US ALL MEMBERS ARE TO TEACH LOVE, TRUTH, PEACE, FREEDOM AND JUSTICE. Contact Grand Sheik Coleman-El.(720-377-4400)or Asst. Grand Sheik Muhammed-El (720-296-8023)

Monday, September 29, 2014

Never Forget

Sunday, September 28, 2014

8 Lessons from the Richest Man in Babylon

8 Lessons from the Richest Man in Babylon (On Wealth Building)

In 1926, George Samuel Clason published a series of pamphlets written in parables that was set in the ancient city of Babylon. The book became known as “The Richest Man in Babylon” and has become a classic in financial literature. I first encountered this little book when I graduated college and was blown away by the simplicity of the story and by the tried-and-true lessons it presented for accumulating wealth.

In 1926, George Samuel Clason published a series of pamphlets written in parables that was set in the ancient city of Babylon. The book became known as “The Richest Man in Babylon” and has become a classic in financial literature. I first encountered this little book when I graduated college and was blown away by the simplicity of the story and by the tried-and-true lessons it presented for accumulating wealth.

The story sprang from the characters Bansir who was a chariot builder and Kobbi who was a musician. The two had become the best at their craft but yet had no money and were poor. They went out to seek the advice of their childhood friend Arkad who in contrast had grown very rich and amassed fortunes.

The lessons that Arkad provided for his friends was the premise of the book and they are lessons of wealth building habits that I believe every rich person had followed to accumulate their wealth. Below are lessons in this book that has helped me and many others become financially stable and wealthy and I believe these lessons will help all of us build a firm financial foundation on our way to becoming the richest person we can become.

1. Pay Ourselves First ( “Start thy purse to fattening.”)

One of the greatest lesson the book has taught is this first lesson. When Bansir and Kobbi seeked the advice of their very wealthy friend Arkad he tells them a story. Arkad was once a poor scribe who made a deal with a rich man to find out the secret to wealth in exchange for his work on a clay inscription. The rich man gave him a very valuable advice ”I found the road to wealth,” he said, “When I decided that a part of all I earned was mine to keep. And so will you.” Although this is a very subtle message it is very powerful in accumulating wealth. We cannot accumulate wealth if we do not save what we earned. We can do that by paying ourselves first and foremost before we spend any of the money we have earned.

Did you ever wonder why the U.S. government takes taxes on our wages before we can get to it? The U.S. government (IRS) knows this law well. They pay themselves first with our money. This is why we must be vigilant to pay ourselves first with every money we earn. The book recommends that we pay ourselves 10% of all that we earn. For every dollar that we earn, 10 cents should go to pay the person you see in the mirror every morning. You may call it the “Me Tax” if you like. The difference between rich financially stable people versus poor broke people is knowing this first rule. Wealthy people pay themselves first and poor people do not. Before we start paying others or start spending the money we earn we need to pay ourselves first.

“If you have not acquired more than a bare existence in the years since we were youths, it is because you either have failed to learn the laws that govern the building of wealth, or else you do not observe them.”“A part of all you earn is yours to keep. It should be not less than a tenth no matter how little you earn. It can be as much more as you can afford. ““Pay yourself first”

2. Live below our means. (“Control thy expenditures”)

If we have paid ourselves first at least 10% of what we earn that leaves us with 90% or less of our income to live on. Controlling our expenditures enable us to make good use of the money we have left over after we have paid ourselves. There have been many advice on frugality over the years but I think it will not solve the problem for the majority of us until we truly define what money is to us and also define the difference of need vs. want. I wrote about this on the guide to becoming smart about money.

“Budget your expenses so that you may have money to pay for your necessities, to pay for your enjoyments and to gratify your worthwhile desires without spending more than nine-tenths of your earnings.”

The best advice to becoming wealthy is to keep expenditures down even when our earning power increases. Many of us have the habit of spending more as we earn more and it’s not unusual to see someone splurging and suddenly their expenses go up as they start earning more. For example, if we suddenly have a $2,000 – $3,000 raise it is best to maintain our current expense level as if the raise never happened. Instead we can tuck that extra money away into our savings or investment. Controlling expenditures will mean living below our means. When we live below our means we accumulate wealth faster. We can think of it in this way, our earning power is our ‘offense’ and controlling our expenditures is our greatest ‘defense’.

3. Make our money work for us. (“Make thy gold multiply”)

I believe this lesson is about investing our money and letting it work for us. I personally believe that each and every one of us should think about investing only after we have built our savings and an Emergency Fund. After we have accumulated 6-8 months worth of expenses in our Emergency Fund it is only then that we should consider about investing our money on other investment vehicles. Our Emergency Fund is a security blanket especially during this time of economic downturns.

” …put each coin to work so that it may reproduce its kind even as the flocks of the field and help bring to you more income, a stream of wealth that will flow constantly into your purse.”

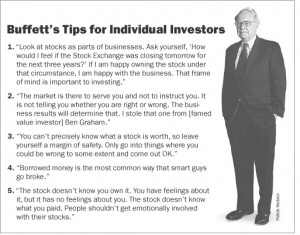

If everything else is good and gravy, making our money work for us is a great way to accumulate wealth. There are many investment vehicles we can tackle but the best thing we should all be aware of is that we should never invest in anything we do not completely understand. Investing our money will mean becoming knowledgeable about what we are investing in as well as the repercussions if the investment does not pan out as well as our potential exit strategies when we are ready to take our money out. There are many ways we can invest our money such as stock markets, real estate, businesses, and so on. We must do our diligent effort to find great investments so we ensure our money will multiply and work for us.

We should also invest our money to ensure we have a steady and safe income while taking advantage of compounding interest we receive from our investments. Time is our biggest ally and as our investment accumulate interest and the money we get from the interest earns interest and so on this is how we can make our gold multiply.

4. Insurance protects our wealth. (“Guard they treasures from loss.”)

Have you ever had a car accident? I have. I was in an intersection when a car on the left passed a red light and hit my car head on. Thankfully we both did not get hurt. And thankfully we both had insurance. Insurance helps safeguard our wealth by absorbing potential loss and mitigating our financial situation. There are many insurance we can buy and we should do our research on which one and how much we need. A renter’s insurance or a homeowner’s insurance helps protect our homes. Another one is longterm insurance which become suitable to help us as we grow older and help protect us from medical expenses and long-term care.

We should all consider buying insurance now in case we need it if something happens. This is a proactive approach and one we should take and not forget. The idea is that we will never have to use the insurance but in case something does happen we are protected financially from the loss it would have caused.

5. Our home is our biggest expense. (“Make of they dwelling a profitable investment”)

Our homes are potentially the biggest expense we have to tackle. Many of us do not own a home and instead rent one. There is absolutely nothing wrong with that but I believe the lesson we can learn from this one is that we should manage our biggest expense smartly. Many of us have decided to take on a huge mortgage to buy our home and after the real estate bust many were left with homes that lost their value and in many cases were underwater. I believe the lesson we can learn from that was that we needed to ‘live below our means’ and buy or rent a home we can comfortably afford.

Since our home is our biggest expense we must play great defense in this arena to lessen that expense as much as possible. I learned this lesson when I bought my first home. I can afford a home twice as much as the price of my current home but I was happy with the home I bought. It was affordable, in a location that I liked, and had enough space for myself. I do not sweat the mortgage since it is comfortably affordable for me and I am trying to pay it off faster with the extra money I earn.

I know that many think their homes are an investment but the truth is it really is not. It is an expense and a very high expense at that and one we must manage carefully.

6. Have a retirement plan. (“Insure a future income.”)

A 25 year old earning an annual salary of $40,000 with an annual raise of say 3% will have earned an estimated $3 million if they retire by age 65. That’s about 40 years of working and earning. We should have a retirement plan if we want to retire comfortably. We can do that by setting aside money to be invested for our retirement. There are many retirement investment plans out there such as 401K, Traditional IRA, Roth, etc. The younger we can start putting money away for our retirement the better. When we start putting money away for retirement early we take advantage of a magical thing called ‘compounding interest‘.

Compounding interest is known as the eight wonder of the world. Benjamin Franklin knew of this knowledge. Did you know that Benjamin Franklin left 1,000 pounds (about $5,000 in today’s money) when he died to a trust. He bequeathed that trust and left it to his favorite cities Philadelphia and Boston with the provision that the money was to remain untouched for as long as 200 years. What was left in the trust after it grew was the amount of $2 million given to Philadelphia and a whooping $5 million for Boston. The lesson we can learn from this is to make time work for us when we plan for retirement by starting early. Time can be our retirement’s greatest friend.

“Remember that money is of a prolific generating nature. Money can beget money, and its offspring can beget more.” – Benjamin Franklin

7. Invest in ourselves. (“Increase thy ability to earn.”)

The best way we can increase our earning is by investing in ourselves. We can do that by continually learning and striving to develop ourselves. We are now in a very exciting time: the Information Age where knowledge is literally within our fingertips thanks to the Internet. I really love the OpenCourseware idea where many schools including Ivy Leagues post their whole class courses for free. It’s a great way to learn on our own. Another one is Coursera which has many online courses for free from Finance to Philosophy, check it out.

“Those eager to grasp opportunities for their betterment, do attract the interest of the goddess of fortune. She is ever anxious to help those who please her. And who is she pleased with? She is pleased with those who do - rather than those who merely talk and engage in wishful thinking. Action will lead you forth to the successes you desire.”

There are many things we can learn on our own and should strive to make ourselves well-rounded. Whether we learn to eat more healthy, enhance our current work skills, or learn to make more money, we must take the initiative to invest in ourselves. When we become smarter and wiser our ability to earn more also increases.

The 5 Rules of Gold from the “Richest Man in Babylon”Gold comes gladly and in increasing quantity to any man who will put by not less than one-tenth of his earnings to create an estate for his future and that of his familyGold labours diligently and contentedly for the wiser owner who finds fir it profitable employment, multiplying even as the flocks of the fieldGold clings to the protection of the cautious owner who invests it under the advice of men wise in its handlingGold slips away from the man who invests it in business or purposes with which he is not familiar or which are not approved by those skilled in its keepGold flees the man who would force it to impossible earnings or who follows the alluring advice of tricksters and schemers or who trusts it to his own inexperience and romantic desires in investment

8. Track Our Wealth. (Know where you are and where you are going.)

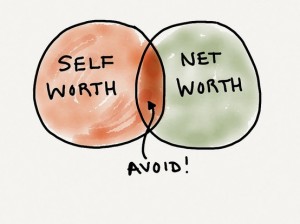

In order for us to know where we stand financially we need to face the whole truth of our current situation. We can do that by tracking our current wealth or lack thereof. This is a tough exercise but we must face the truth of how we earn and spend our money in order for us to know where we are going. There is a big difference between wealthy people and those who are not, wealthy people know their net worth while the poor do not pay particular attention nor care at all about tracking their assets and liabilities.

Thursday, September 11, 2014

Moorish Questionair 5 & 11.

Randy Lee rebuts the IRS

The following court reporter's transcript has been re-formatted for this publication. We have placed XXX in places where identification of our Brother's family name was obvious. The court reporter's name and telephone number is shown within the document if you would like to verify the transcript for yourself, or, you may contact the Assistant U. S. Attorney's office at their address shown. Note that both their addresses are in the Federal Building at Los Angeles. Since we know the "Defendant" in this matter, we have first hand knowledge of the fact that this is an accurate detail of the words spoken in the court room. This is proof that a misnomer or mistaken identity (nom de guerre) is a valid defense for every Christian when He is brought before the present day military rule courts of the Federal U.S. Please note that the capitalization is exactly as was written on the original transcript. Certain positions within the page, margins, and tabs are not the same in order to format for this publication but have no bearing on the accuracy of the contents quoted herein.Note that Brother Randy did not "appear", but rather "responded" by Visitation with Christ Jesus; that he did not admit to be a "resident" of any State or Federal District; and, that his Law is the Word of God, and nothing else. He accurately spelled out his Christian Appellation for the record so there was no mistake about the difference between who he was as to whom they claimed he was.

This is not a "silver bullet" nor is this a "sovereign movement quick fix". If you are a "patriot" or a member of a "militia" and the Lord God is not first in your spirit, life, heart, and mind, then this material is not for you. If you are a Good and Lawful Christian above all other identities of this world, then we pray this material strengthens you in your stand with Christ Jesus here on this earth against the evil that surrounds you.

UNITED STATES DISTRICT COURTTHE CLERK: Item number 6, case number CV-94xxxxx, United States of America versus Randy L. Oxxxxxxxxxr.

CENTRAL DISTRICT OF CALIFORNIA

HONORABLE JOHN G. DAVIES, JUDGE PRESIDING

UNITED STATES OF AMERICA ) ) Plaintiff(s) ) ) vs. ) NO. CV-94 xxxx -JGD ) RANDY L. OxxxxxxxxxR ) ____________Defendant(s)_ )REPORTER'S TRANSCRIPT OF PROCEEDINGS

Los Angeles, California - Monday, March 21, 1994

BEVERLY A. CASARES CSR# 8630 Official Court Reporter 312 North Spring Street, Room 440 Los Angeles, California 90012 (213) 617-2305 APPEARANCES: FOR PLAINTIFF(S) GREGORY A. ROTH 312 N. Spring Street Los Angeles, California 90012 (213) 894-2410 FOR DEFENDANT(S) RANDY L. OxxxxxxxxxRLOS ANGELES, CALIFORNIA; MONDAY, MARCH 21, 1994; 1:30 P.M.

MR. ROTH: Good afternoon, your Honor, Assistant U.S. Attorney Gregory Roth appearing on behalf of the United States, and its agency the Internal Revenue Service.

THE COURT: Is there any opposition?

MR. OxxxxxxxxxR: For the record.

THE COURT: Yes.

MR. OxxxxxxxxxR: My Christian name is Randy Lee, and my family name is Oxxxxxxxxxr.

THE COURT: All right.

MR. OxxxxxxxxxR: That is spelled capital R, lower case, a-n-d-y, capital L, lower case e-e, capital O, lower case x-x-x-x-x-x-x-x-x-r.

I have responded to this petition because it was found on the door of the place where I take up housekeeping, and attempts to create a colorable persona under colorable law by the name of capital R-A-N-D-Y L period, O-x-x-x-x-x-x-x-x-x-R, the artifice being used here to deceive this Honorable Court, must be abated as a Public Nuisance.

For the record, Randy Lee and Jesus the Christ Advocate and Wonderful Counselor are using the Right of Visitation to exercise Ministerial Powers to be heard on this matter.

I, Randy Lee, am a native Californian and a Man on the Land in Los Angeles County, not a resident in the Federal Judicial District in the Central District of California.

My Colors and Authority is the California Bear Flag with the Gold star. My Law is My Family Bible. And my Status is shown by the Seal of the People.

I am who I say I am, not who the U.S. Attorney says I am. Further I sayeth not and I stand mute.

THE COURT: All right. Please take your things off of the podium and sit down at your table. Mr. Roth, do you have any response to this alleged case of mistaken identity.

MR. ROTH: Well, your Honor, Mr. Oxxxxxxxxxr seems to think that if you spell your name in upper and lower case, it relieves him of compliance.

THE COURT: Thank you, Mr. Roth. Please call the next case clerk.

(Proceedings concluded.)

C E R T I F I C A T E

I hereby certify that the foregoing matter entitled UNITED STATES OF AMERICA versus RANDY L. OxxxxxxxxxR No. CV-94 xxxx -JGD is transcribed from the stenographic notes taken by me and is a true and accurate description of the same.

_____(signed)____________________. ____3/25/94________________.

BEVERLY A. CASARES CSR# 8630, Official Court Reporter

Randy Lee explains There is a maxim of law, "Scire leges, non hoc verba earum tenere, sed vim et potestatem," which in English is "To know the law is, not to observe their mere words, but their force and power." Bouvier's (1914), page 2162.

This is the problem that the church (the body of believers) has. They know the words, and many can rattle the verses off of their tongue like silk, but they have no idea how to execute their [God's] Law. A testament is meaningless unless it can be executed. Where Christians lack knowledge is in the area of procedural law. How do we execute The Testament of Jesus Christ?

"Mistaken identity" not only takes in 'the name,' but more importantly, it takes in the force and power of 'the law of one's forum.' The questions in the mind of the judge would be, "what law do you identify with? Where do you reside? Who is your master, etc." These questions all concern your 'identity.'

In short, 'the name' really wasn't the main article concerning the 'mistaken identity.' It appears to be, because Mr. Roth ended by referring to the spelling of the name. I don't know if that was ignorance on his part, or a ruse. The spelling of the name concerns 'misnomer,' which is only a small part of 'identity.'

When one walks into a foreign court, one must import their law into that court in order to distinguish and separate himself from that court's foreign law. The spelling of the name would have been meaningless without importing 'The Law', which is The Bible and The Word of God, and also stating that I was 'exercising ministerial powers' under Jesus Christ. These are the marks that lead to a decision of 'mistaken identity.' Judge Davies, who is the presiding judge for the district, knew exactly what I was doing, and gave me recognition, not because of the words that came out of my mouth, but because of their force and power. The maxim of law, 'All men know God' would apply in this case, because I came in a ministerial capacity under God.

The reference to 'mistaken identity' most importantly referred to me not being 'a resident of the federal judicial district of the central district of California.' The 'residency' requirement in civil cases is paramount in establishing jurisdiction for the court to hear the case. When I made that statement, Mr. Roth didn't rebut it, so Davies had to drop the case. Why wasn't Roth able to rebut residency? I don't have a driver's license, an address (general delivery is not an address), corporate employment, etc. In other words, Davies could see from what was presented to him, that I wasn't serving two masters.

So, when reading a transcript or court decision, always take into account all of the possibilities of what a word or a combination of words is referring to. Lawyers and Judges can be very good at covering up the true meaning of a situation.

As a side note, a friend of mine went before a different judge 2 weeks later on an 'Order to Show Cause.' He used basically the same argument as me. Mr. Roth was the U.S. Attorney again, and the case ended with the same results as mine. Mr. Roth again referred to 'the name' and the judge, again, referred to 'mistaken identity.'

Tuesday, September 9, 2014

A Message From York-El

Friday, September 5, 2014

Can You See??

Subscribe to:

Comments (Atom)